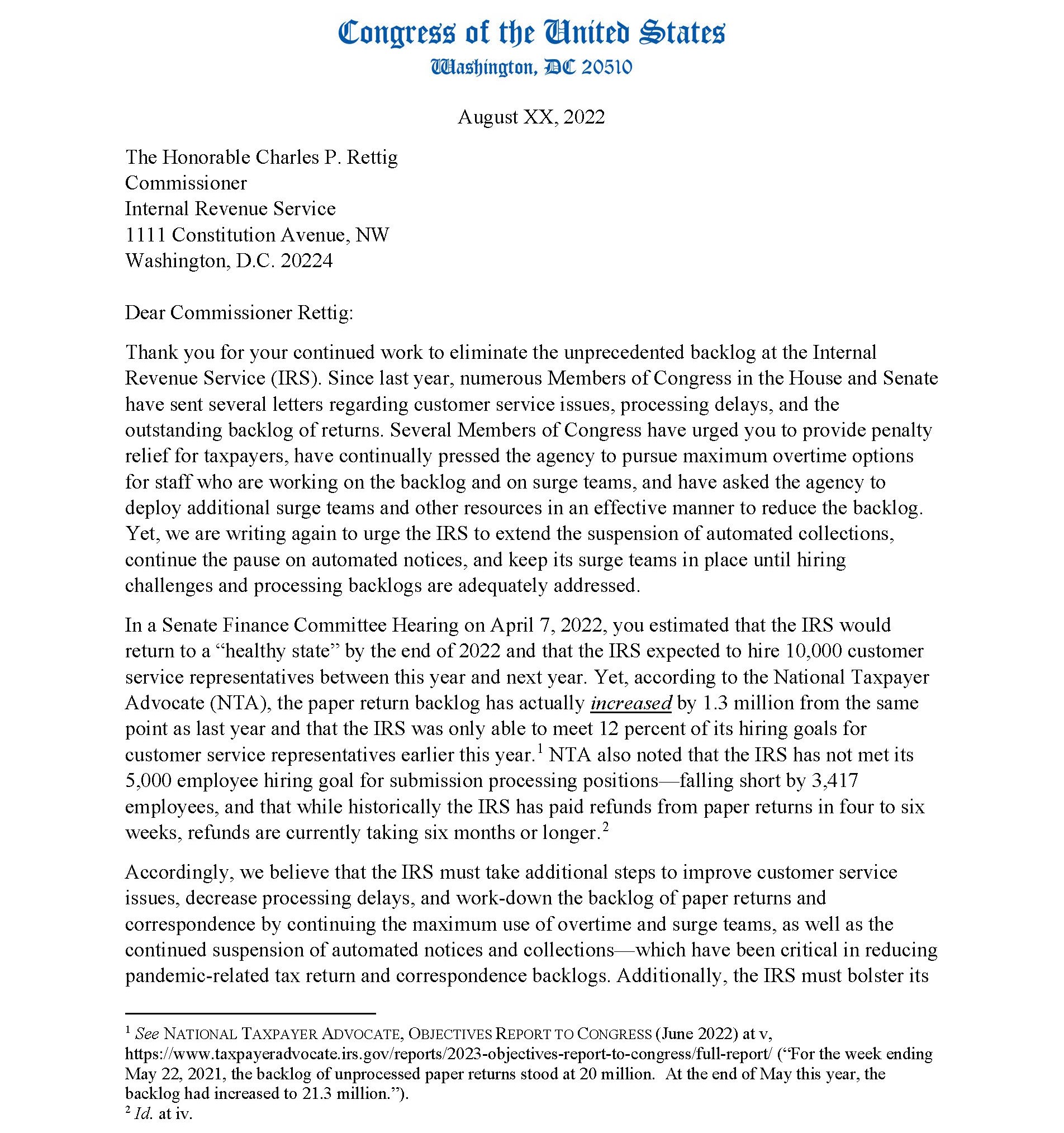

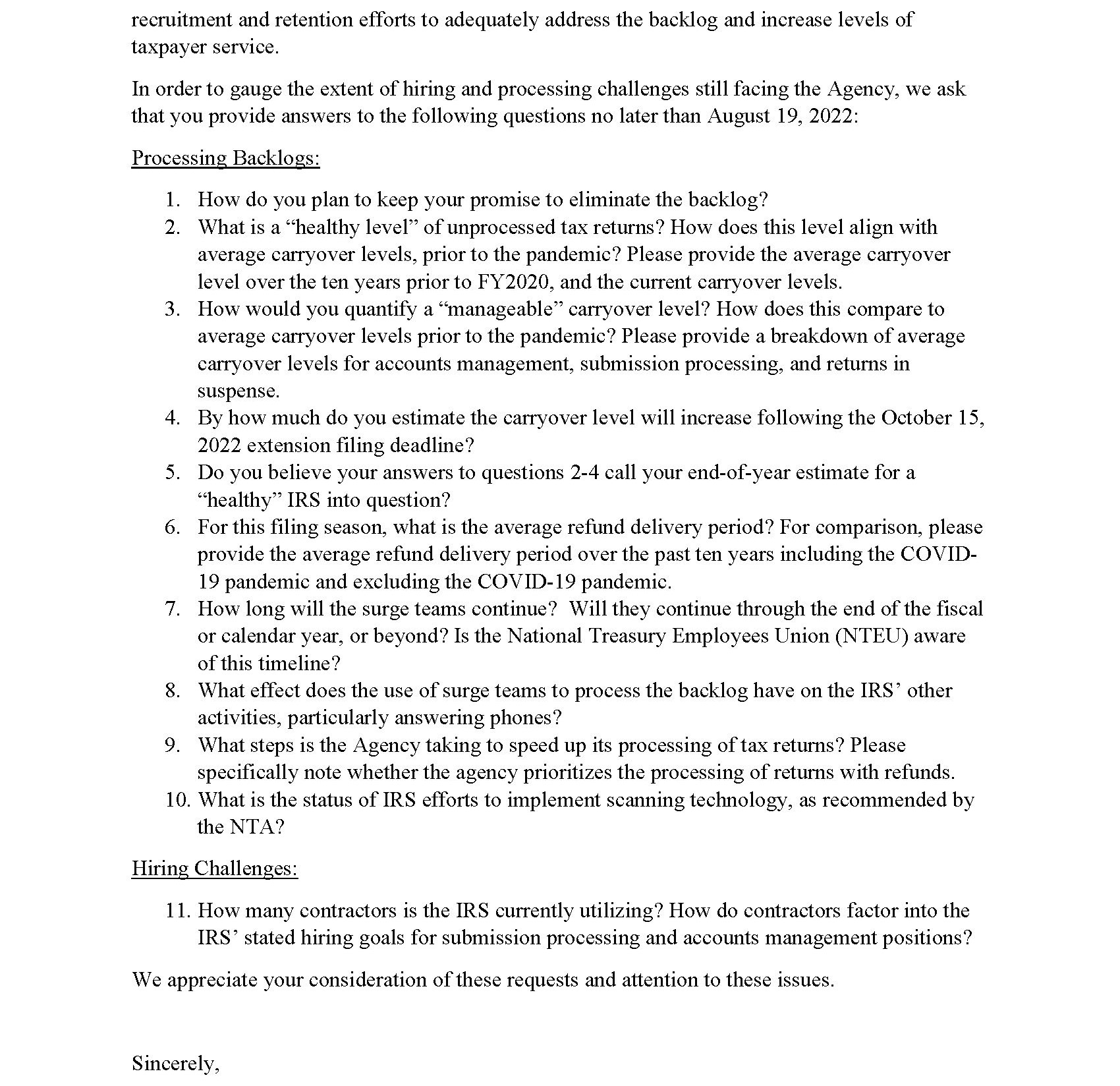

This week, the AICPA, with support from the FICPA and other state societies, secured the signatures of 93 members of Congress on a bipartisan, bicameral letter pushing the IRS to further address its backlog and ongoing service issues.

The letter, led by Abigail Spanberger (D-VA) and Brian Fitzpatrick (R-PA) in the House and Bob Menendez (D-NJ) and Bill Cassidy (R-LA) in the Senate, follows previous letters on the same topic.

It asks the IRS to consider continuing the suspension of automated collections, continuing the pause on automated notices, and keeping existing surge teams in place until hiring challenges and processing backlogs are adequately addressed.

These measures – all of which the IRS can enact on its own – should lessen the risk that individual and small business taxpayers, as well as practitioners, will face a 2023 tax-filing season with unprecedented levels of unprocessed returns resulting in incorrect notices and penalties.

The FICPA contacted all of Florida’s 27 U.S. House members requesting their signatures on the letter.

As a reference, here is the AICPA’s July 11 letter to the IRS and Treasury on additional measures to reduce the backlog.

The letter from the members Congress to the IRS appears below: